Dear Friends,

I am sure you know that I am a fan of Ben Bernanke if you have followed our investment blog. But as Ben retires from the FED chairman post, a new hero in Wallstreet emerged. or maybe heroine :).

It seems that Ben has trained and taught Yellen a trick or two how to motivate the Wallstreet guys, charm them into believing in the "Accommodative monetary policy" dream.

She says in yesterday Senate hearing that " it was difficult to tell how much of the recent decline in U.S. economic growth was due to weather, adding the central bank might consider a pause in its reduction of bond buying if the weakness persists."

Surely, we all know that winter is a seasonal effect and most likely it will be over in the next 2 months. Will the economy really cripple because of this cold winter? Does Yellen need to really stop the tapering just for these 2 months, so that US unemployment rate really heads for 2%? I don't think "weather" is the point. She is just a stock market manipulator!

Ha, I thought Bernanke is good with words, but Janet Yellen seems better! She uses the weapon of accommodative monetary policy everytime she appears to talk.

And it is because of this fact that we predicted Dow will bounce back from its deep drop in January. Those who have followed us have known that we predicted this quarter DOW and S&P500 will still hit historical high! And we think this run will continue after the historical high.

Indeed yesterday S&P500 close at a new historical high with a Yellen knockout verdict! It is DOW turn of making history again in the next few days.

It is unimaginable now to think how high the DOW will go! I know everybody is worried. But I feel that with such loose words about the monetary policy, this bullish run can't seem to stop!

Imagine if there are 2 months where DOW drop another 1500 points and the unemployment rate increases.

I am sure Yellen will not hesitate to put a stop to the QE tapering!

The market will bounce back hard then. And who knows, there is even chance that the printing of money might even increase $10billion if the situation get worse.

So my take for us now is to get in the game whenever DOW drop 10% from the top. This seems an unstoppable bullet train now.

Especially for the first half of 2014!

Rgds

Daniel

www.danielloh.com

Stocks Coffeeshop Talk on US Market / Singapore Market / US Stocks Tips / Singapore Stocks Tips

Friday, 28 February 2014

Janet Yellen is my new Wall Street hero!

骆伟嵩 第8频道《早安你好》电话采访 Interview Summary

美国市场

昨晚美国涨了74点。S&P500也成功跨越了之前的历史高点1850点。美国二月的成绩相当不错,完全去除了一月的跌幅。

我们曾经说过美国似乎很喜欢新的联储局主席耶伦Yellen。每次讲话,似乎股市就往上走。昨晚也不例外。我觉得这个联储局主席的交接,相当成功。

暂时美国的股市和经济我们都觉得还是相当健康,还有往上走的空间。

新加坡市场

·

新加坡海峡指数昨天也上涨了8点。虽然这个星期有点下滑,但整个二月的表现都不错。

·

我们判断海峡接下来几天可能会迈向3150点的管卡。短期还是有上涨的空间。这个星期有一点下滑大家不必太担心。还是一个进场的机会。

Nam Cheong南昌

·

Nam Cheong 南昌两天前公布了业绩报告,表现相当不错。我觉得大家可以留意这支股票。有两个原因。

·

第一是他们在今年2013年的成绩有比2012年还要好。2012年他们卖了21艘船。2013年卖了30艘船,第4季度的表现也相当不错,比分析师的预测还要好。

·

当然第二个我们觉得这支股票不错的原因是他们预测2015年的成绩会比2014年还要好,他们目标卖35艘船。这个成绩也比一些分析师的预测还要高。

·

因此我们对Nam

Cheong 南昌的走势还是蛮乐观的。

Wednesday, 26 February 2014

Seminar by Andy Yew on US and Malaysia Stocks

Do you know that the US and Malaysia Stock market is in a Strong Bull Run now? Do you feel that you missed out on the Run and you should have learn more about other market earlier. Dont worry! In this coming seminar, we are going to share with you some homework we have done to help you to Get familiar with the US and Malaysia Stock market.

The US stock below Up 500% in 15month, you probably dont see many this kind of stock in Singapore Market.

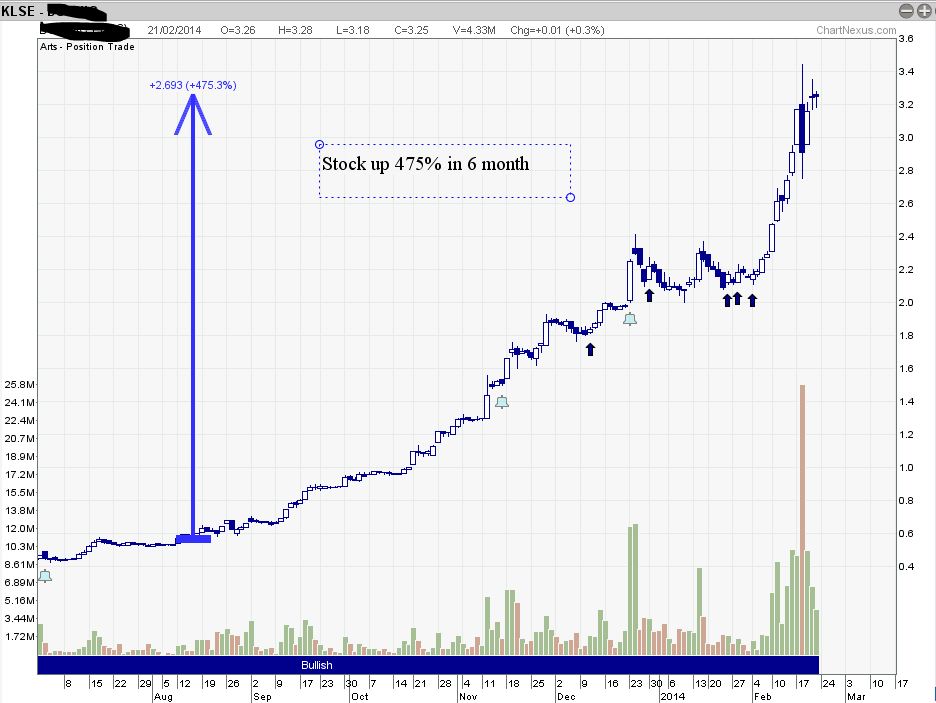

The Malaysia stock below Up 475% in 6month, again, you probably dont see many this kind of stock in Singapore Market.

In this coming Seminar we will be sharing on

1)What are the stocks the is going Consistently uptrend and How you can SPOT these stocks.

2) Is the US market reaching the Top Soon?

3) How can you exit a trade safely

4) Basics of the US market and Malaysia market you need to Know.

Date: 27 Feb 2014, Thu (English Seminar) 7pm - 10pm

Venue: 141 Cecil Street, Tung Ann Association Building #07-02 S(069541)

Tanjong Pagar MRT Exit G, walk straight 80m, opposite the traffic light

US Stock Tip: Facebook runs like a bullet train! But how now?

Dear Friends,

If you have been reading our blog or hear me in media, you would have known that I have been talking profusely about Facebook being a retirement portfolio stock!

Articles where I posted on Facebook and my reasons why you should buy whenever it drops!

31st July 2013

http://www.danielloh.com/2013/07/this-may-be-one-stock-for-your.html

12th Sep 2013

http://www.danielloh.com/2013/09/us-stock-tip-did-you-follow-our-call-on.html

12th Dec 2013

http://www.danielloh.com/2013/12/us-stock-watch-facebook-just-keeps.html

I have been asking people to buy this stock when it was $35. Within a short period of 6 months, it has doubled itself to $70! On Monday, it reached $71 highest.

In this great 5 years bull run, seldom would I recommend a stock to hold long term! Reason is I don't think there are many stocks left tat may double or triple in price in the next few years!

BUT Facebook is my pick to double, triple or even quadruple its price from now in the long term!

Any time it drops 10-15%. it is BUY BUY BUY!

People ask me about twitter compared to facebook. I know that Twitter did make a good run too this year, but, it is definitely not in the same world of facebook! It has no earnings and plan how to monetize its business yet. I basically cant see the revenue model growing to be like the next google or apple.

But facebook is different!

But

I do predict that Facebook will have a disappointing quarterly earnings next season!

We do predict a gap down on the next earnings, and rest assure that I will be catching this stock once it gaps down! It is angbao drop from sky!

Just Before next earnings, it will be overpriced. Long term it is still underpriced to me!

If you can withstand the gap down, hold on for 10 years is my advice!

Rgds

Daniel

www.danielloh.com

If you have been reading our blog or hear me in media, you would have known that I have been talking profusely about Facebook being a retirement portfolio stock!

Articles where I posted on Facebook and my reasons why you should buy whenever it drops!

31st July 2013

http://www.danielloh.com/2013/07/this-may-be-one-stock-for-your.html

12th Sep 2013

http://www.danielloh.com/2013/09/us-stock-tip-did-you-follow-our-call-on.html

12th Dec 2013

http://www.danielloh.com/2013/12/us-stock-watch-facebook-just-keeps.html

I have been asking people to buy this stock when it was $35. Within a short period of 6 months, it has doubled itself to $70! On Monday, it reached $71 highest.

In this great 5 years bull run, seldom would I recommend a stock to hold long term! Reason is I don't think there are many stocks left tat may double or triple in price in the next few years!

BUT Facebook is my pick to double, triple or even quadruple its price from now in the long term!

Any time it drops 10-15%. it is BUY BUY BUY!

People ask me about twitter compared to facebook. I know that Twitter did make a good run too this year, but, it is definitely not in the same world of facebook! It has no earnings and plan how to monetize its business yet. I basically cant see the revenue model growing to be like the next google or apple.

But facebook is different!

But

I do predict that Facebook will have a disappointing quarterly earnings next season!

We do predict a gap down on the next earnings, and rest assure that I will be catching this stock once it gaps down! It is angbao drop from sky!

Just Before next earnings, it will be overpriced. Long term it is still underpriced to me!

If you can withstand the gap down, hold on for 10 years is my advice!

Rgds

Daniel

www.danielloh.com

Singapore Stock Watch: Utd Envirotech retraced at $1.30 like what we predicted

Dear Friends,

We got this stock right again!

In the article dated 14th Feb, we mentioned that Utd Envirotech has done well like what we predicted, going from $0.80 plus cents to $1.25.

But we warned that $1.30 is still a resistance. After touching $1.29 recently, it drops for a few days.

http://www.danielloh.com/2014/02/singapore-stock-watch-utdenvirotech.html

Today it stands at $1.23.

It is not easy to make a good judgment to buy a stock! And it is more difficult to predict the point to sell a good stock that is running like crazy!

We have predicted there be a consolidation at $1.30! We are off by 1 cent for this case. It stop at $1.29!

This method that we used consistently to predict the price where stock run halts is what I called "Law of Gravity of Price".

Where we think this stock might be now?

2 scenarios...

1) If it stays in $1.20-$1.30 region for at least 2 weeks without dropping below $1.20, then it has a chance to break $1.30 still

2) If it breaks down $1.20 within 1 month, this stock is heading for $1.10 at least, a good point to pick up the stock would be between $1.05-$1.10!

Let us see if I am right again...;)

Rgds

Daniel

www.danielloh.com

We got this stock right again!

In the article dated 14th Feb, we mentioned that Utd Envirotech has done well like what we predicted, going from $0.80 plus cents to $1.25.

But we warned that $1.30 is still a resistance. After touching $1.29 recently, it drops for a few days.

http://www.danielloh.com/2014/02/singapore-stock-watch-utdenvirotech.html

Today it stands at $1.23.

It is not easy to make a good judgment to buy a stock! And it is more difficult to predict the point to sell a good stock that is running like crazy!

We have predicted there be a consolidation at $1.30! We are off by 1 cent for this case. It stop at $1.29!

This method that we used consistently to predict the price where stock run halts is what I called "Law of Gravity of Price".

Where we think this stock might be now?

2 scenarios...

1) If it stays in $1.20-$1.30 region for at least 2 weeks without dropping below $1.20, then it has a chance to break $1.30 still

2) If it breaks down $1.20 within 1 month, this stock is heading for $1.10 at least, a good point to pick up the stock would be between $1.05-$1.10!

Let us see if I am right again...;)

Rgds

Daniel

www.danielloh.com

Friday, 21 February 2014

Free Seminar: Views from Mr Hu Li Yang on 2014 market 免费讲座: 亚洲股神胡立阳老师对2014年股市的看法

<<Views from Mr Hu Li Yang on 2014 market>>

<< 亚洲股神胡立阳老师对2014年股市的看法>>

Date: 25 Feb 2014, Tue (English Seminar) 7pm - 10pm

26 Feb 2014, Wed (华文讲座) 7pm - 10pm

28 Feb 2014, Fri (华文讲座) 7pm - 10pm

Sharing on

1) Outlook for first quarter 2014

2) Will the Market tumble in 2014

3) 3 Entry signals you should watch out for in buying stocks

4) 3 Exit signals to alert you

5) Ways to always know the turning point of a market

Venue: 141 Cecil Street, Tung Ann Association Building #07-02 S(069541) Tanjong Pagar MRT Exit G, walk straight 80m, opposite the traffic lightSpeaker: Daniel Loh

Regular invited speaker for Mediacorp FM958

Regular invited speaker for Mediacorp Channel 8 Financial Programmes

SIAS investment trainer

Invited speaker for Phillip Securities

SIAS investment trainer

Invited speaker for Phillip Securities

Invited speaker for Affin Investment Bank

or SMS <Name><Email><HP><Date><Number of seats> to 93676623

FREE Malaysia Stock Seminar

Topic: <How do you identify GEM stocks like MKH & DataSonic? >

Recently we have identified Big players scooping up this stock MKH on 10th January. When we held a seminar in KL, Cititel, we asked everybody to take note of this stock. Check out this cropped out chart on 10th January where we issued the buy call! MKH was $3.10 then.

This is the price of MKH now, $4.10 within a period of one month!

Do you wish to know the next malaysia stock that we are watching now that may run like MKH and DSonic? Come for our seminar this weekend to find out!

What you will learn:

1) KL Stocks you may see this 1Q 2014?

2) Market Outlook for 2014

3) What is the market direction for Asia and US market?

4) Secrets of stocks

Date : Sunday, 23 Feb 2014

Time : 2.00 – 5.00pm

Venue :

Hotel Armada, Petaling Jaya, Level 3, Room Arista,

Lot

6, Lorong Utara C, Section 52,

46200

Petaling Jaya,

Selangor

Darul Ehsan Malaysia

Speaker: Daniel Loh

Speaker: Daniel Loh

MediaCorp Radio Station FM958 Stock Market Analyst

MediaCorp TV Channel 8 Stock Market Analyst

MediaCorp TV Channel 8 Stock Market Analyst

Raffles Business International Chief Trainer

Affin Investment Bank Invited SpeakerShares Investment Columnist

Phillip Securities Invited Speaker

Affin Investment Bank Invited SpeakerShares Investment Columnist

Phillip Securities Invited Speaker

OCBC Securities Invited Speaker

Seats are limited!! 100 seats, Left 25 seats only!

To register, please CALL in +6016 310 5528 to book or SMS <NAME><HP><Email><No of Seats><B> to +6016 310 5528

Wednesday, 19 February 2014

Radio Interview today "Is the market healthy now?" 今天电台访问 “市场还健康吗?”

美国市场

·

两个星期前的星期五,上了Di Cong的节目有提到股市已经掉的差不多,让大家可以开始买股票,慢慢买上去。我们判断美国道琼斯已经到了谷底,当然两个星期后我们回头看,庆幸的是我们确实抓的相当准。今天我们再次回顾一下。

·

这两个星期,道琼斯已经从15350点到16150点,上涨了差不多800点。上周也是今年道琼斯最好的一周。

· Nasdaq现在是4244点,也创下只从2000年以来的高点。

·

请让我解释为什么我们觉得美国股市还是处于健康的状态

·

在一月的时候,美国大掉,大家都在讨论两个话题。

·

1)大家担心QE开始慢慢降了会不会有很大的影响。我觉大家不必再操心QE降低得问题,我觉得QE这个讨论对股市不会再有冲击了。因为我们都已经知道答案了。联储局已经让我们知道每次可能减100亿。到年底可能结束。当我们已经知道答案,接下来就不会有恐慌。这个联储局透明化的政策对股市来可说是一件好事,大家不用过于担心。

·

2) 第二个可能让大家担心,每个人都在说资金从新新市场外流会不会照成新新市场经济崩溃。我觉得大家也不用担心。我们判断新新市场的股市都掉得差不多了。大家听媒体的消息已经晚了。新新市场的股市如果大家不晓得,已经掉了一年了。去年5月当Bernanke宣布要接触QE的时候,资金早就从新新市场流出。去年巴西股市,泰国股市,印尼股市,新加坡股市都从最高点跌了下来。新加坡从3460点跌了下来就没有回去过。印尼从5000多点跌到现在接近4000点都没有回去过。新新市场已经跌了一年了。我承认资金有流出,但是大家要晓得国际资金是很容易流动的,会从高的地方流到便宜的地方。我觉得就是因为新新市场跌得差不多,该是捡便宜的时候。

·

道琼斯现在是16154点。我们判断道琼斯这个季度还会有可能创历史高点。但是今年大家要留意的事,今年下半年,联储局会不会讨论提高利率。这个影响会比QE解除还要大。股市一定有大波动。

·

总的来说,我们还是觉得美国经济和股市都还在很健康的状况,大家不必太担心。

中国与香港股市

·

我们在节目中也一直强调上证2000点以下要买,香港恒生跌到21200点的时候也鼓励大家投资。上证一度掉到1980点,现在上证到了2132点,恒生也到了22580点了。

·

目前上证和恒生还是有上升的空间。但是上证在2200点,恒生在23000点可能会有些压力,大家要注意一下。

新加坡市场

·

新加坡海峡指数最近一度跌到2953的低点。我觉得是一个大好机会。两个星期前我们在节目中提过,我们觉得3000-3050点是海指的支持点。如果股市没信心,再跌50点,到2950我们觉得可能是财神爷给大家的新年红包。真的当时海指就到2953反弹了。

·

今天海指相当强,又上了15点。现在是接近3085点!

·

最近我问很多来听我演讲的朋友有买股票吗?80%说还没有!两个原因,一个是担心。每个人都在恐慌,害怕海指到2800点都不敢进场。第二个原因是没钱了,全部套牢都不敢进场。

·

其实我的想法是很多人买股票太注重细节了。我觉得买股票因该随便一点。如果大家觉得便宜,先买一点。不用等到你觉得真的上了再买。买了就 不去看他。如果有一天STI又回到了3300点再卖掉。很多时候长期投资家会赚钱的原因是因为他们很随便,觉得便宜就买一些玩玩。2950点就是便宜,大不要等到3300点才冲进去买,那是贵的时候。

·

现在我觉得海指还是比较便宜的。两个星期前我也是有提到,大家可以分批进场。两个星期前我举例OCBC, 现在都已经从$9跑到$9.60。大家记得,当你觉得海指便宜的时候,银行股是值得考虑的,因为他的走势跟海指一样。

·

明天新加坡将会提出2014年的预算案。我觉得大家可以留意一下。制造业,建筑业和金融业通常会对预算案比较敏感。大家可以留意是否这些领域的股票的股票会活跃起来。

·

这个星期我在电视节目受采访的时候,主持人有问我关于产业股的看法?

·

我觉得产业股暂时还没什么起色。但是我觉得大家可以留产业股下个季度的进展。为什么我这么说?我们从报纸都可以看得到,政府现在面对各界的压力,房地产发展商,中介公司希望把一些降温措施解出。我估计如果房地产还是低迷的状态,确实第2季或第3季度政府可能会松懈一些降温措施。一旦这样做,大家就可以看房地产股!

·

总的来说,投资新加坡股的朋友,大家先在可以做的就是做好功课,留意那些业绩报告不错的股票,投资一些,放长线。

总结:

大家要记得,我们现在还处于牛市的状态。任何的下滑都是进场的时机。大家不必太担心新新市场有没有出现问题。这些都是媒体炒作的新闻。哪里便宜,资金就会流到哪里。我觉得新新市场已经跌到差不多了。买股票尽量不要在高点买。当美国创历史高点的时候就不买了。当股市回档到便宜时再进场等。最后你才可以做大赢家。

Free Singapore Stocks Seminar by Andy Yew

<< Best Time to Buy Singapore Stocks NOW? >>

现在是最好的时间买新加坡股票吗?

sharing by Andy Yew

Join us to know what Singapore stocks to watch out for!!!

Do recommend your friends to this workshop!

Do recommend your friends to this workshop!

Date: 20 Feb2013, Thu (English Seminar) 7pm - 10pm

21 Feb 2013, Fri (华文讲座) 7pm - 10pm

Sharing on

1) Spore Stocks that are trending upwards that you should take note of

2) Spore Stocks that did well for earnings

3) Spore Stocks that are giving good dividends

4) Spore Stocks that are suitable for short term trading

5) Spore Stocks that are defensive plays

Plus we will be providing analysis on your stocks!

Venue: 141 Cecil Street, Tung Ann Association Building #07-02 S(069541) Tanjong Pagar MRT Exit G, walk straight 80m, opposite the traffic light

Speaker: Andy Yew (ART system Founder)

or SMS <Name><Email><HP><Date><Number of seats> to 93676623

Tuesday, 18 February 2014

第8频道《早安你好》骆伟嵩 现场采访:展望股市脉搏

1. 谈谈本地股市上星期的表现,什么因素影响股市的波动?

上个星期本地STI上了十多点。美国股市只从2月4日到了最低点,新加坡股市也从2月4日2953点跑上来。现在是3030多点。这个好的表现不只发生在本地股市,恒生,上证指数,欧洲指数,东南亚股市这几天都往上走。总的来说,就是因为美国停跌了。

2. 纽约华尔街股市上星期表现如何?有什么因素需要特别注意?

这个星期的表现很好,是今年最好的一个星期。道指整个星期上了350点。Nasdaq也创下只从2000年以来的高点。上个月美国大掉1300点。全世界都在讨论两个话题。

a)QE开始慢慢降了。讲到QE,我觉得大家再也不必担心QE会不会影响股市。不会了,因为我们都已经知道答案了。联储局已经让我们知道每次可能减100亿。到年底可能结束。当我们已经知道答案,接下来就不会有恐慌。

b) 大家可能担心新新市场会不会经济崩溃。大家不用担心。新新市场的股市都掉得差不多了,掉了一年了。QE已经有了答案,我觉得是捡便宜的时候。

3. 新电信集团第三季净利年比增长5.5%,达到8亿7000万元,不过集团警告全年营收和盈利将会下降。你怎样看待这只股和本地电信股的投资潜能?

我觉得如果大家想寻求一支长远投资的股票,新电信是一个不错的选择。长期投资就是要选择一个不怎么掉,有稳定股息的股票。我认为新电信已经在低点的原因有3个。

a) 最近公布的业绩报告和分析师的预测一样,但股价已经跌到52个星期的低点。我们觉得已经掉到了谷底了。

b) 只从5月,新电信就从历史高点掉了下来。这也是因为当时QE宣布可能接触的关系照成澳币狂跌。新电信最大的营业额是在澳洲。澳币跌影响到了盈利。但是我们觉得澳币已经跌到谷底。现在可能开始走强一点。

c) 相比3支股票,我觉得新电信长远的潜力比较好。新电信已经拓展海外市场,他的营业额已经不限制在新加坡。澳洲是最大的投资。他们也在印尼和印度有生意。开始可能不容易甚至亏钱,可是长期会受益。

4. 本地股市走势接下来的展望?什么原因?

海指已经从2950跑到了3038点。我们觉得现在海指可能在2950点到3150点之间波动。如果到了3150点要小心。如果跌到2950点是一个机会。是否现在会继续往上走,我们要看美国。这个星期还是有可能往上走的。

5. 纽约华尔街股市接下来的波动,是起还是跌?

我觉得这个上升的趋势是有可能继续的。之前当Bernanke 上台讲话的时候,很多时候股市都会上。现在我们觉得Yellen 似乎得到了Bernanke 的真传,每次上台都得到华尔街的欢迎,股市通常表现不错。这个星期四Yellen又会上台,我们看是否这对股市是利好消息。

6. 本地个别领域方面,哪一些行业的股票会有好的表现?

今年年头我上节目时又推荐环保领域的股票,也特别让大家注意Utd Envirotech。当时是80cts多。现在已经是$1.25了。虽然我觉得环保领域因为中国的原因还是今年受瞩目的领域,但是这支股已经跑太多了,大家要小心。

我现在在留意医药领域, 特别是Raffles Medical 大家留意一下。几个星期前节目让我研究讲一下这支股票。当时接近$3.06。现在是$3.17。我们觉得这支股票可做长期投资。因为Bugis会在开医院,长期值得投资。

7. 投资者接下来需要注意哪些因素?

今年我觉得投资者要注意联储局是否在年底会要准备提高利率。目前来看,最可怕的是利率的上升。半年前,股市一定有波动。短期,大家可以称这个时候做好功课,留意着一次盈利的报告,看哪一支股票好的再投资。

8. 你怎样看待以下个别领域的走向:产业股和建筑业股?

我觉得产业股和建筑股暂时还没什么起色。但是我们从报纸都可以看得到,政府现在面对各界的压力,房地产发展商,中介公司希望把一些降温措施解出。我估计如果房地产还是低迷的状态,确实第2季度政府可能会对松懈一些降温措施。一旦这样做,大家就买房地产股!

上个星期本地STI上了十多点。美国股市只从2月4日到了最低点,新加坡股市也从2月4日2953点跑上来。现在是3030多点。这个好的表现不只发生在本地股市,恒生,上证指数,欧洲指数,东南亚股市这几天都往上走。总的来说,就是因为美国停跌了。

2. 纽约华尔街股市上星期表现如何?有什么因素需要特别注意?

这个星期的表现很好,是今年最好的一个星期。道指整个星期上了350点。Nasdaq也创下只从2000年以来的高点。上个月美国大掉1300点。全世界都在讨论两个话题。

a)QE开始慢慢降了。讲到QE,我觉得大家再也不必担心QE会不会影响股市。不会了,因为我们都已经知道答案了。联储局已经让我们知道每次可能减100亿。到年底可能结束。当我们已经知道答案,接下来就不会有恐慌。

b) 大家可能担心新新市场会不会经济崩溃。大家不用担心。新新市场的股市都掉得差不多了,掉了一年了。QE已经有了答案,我觉得是捡便宜的时候。

3. 新电信集团第三季净利年比增长5.5%,达到8亿7000万元,不过集团警告全年营收和盈利将会下降。你怎样看待这只股和本地电信股的投资潜能?

我觉得如果大家想寻求一支长远投资的股票,新电信是一个不错的选择。长期投资就是要选择一个不怎么掉,有稳定股息的股票。我认为新电信已经在低点的原因有3个。

a) 最近公布的业绩报告和分析师的预测一样,但股价已经跌到52个星期的低点。我们觉得已经掉到了谷底了。

b) 只从5月,新电信就从历史高点掉了下来。这也是因为当时QE宣布可能接触的关系照成澳币狂跌。新电信最大的营业额是在澳洲。澳币跌影响到了盈利。但是我们觉得澳币已经跌到谷底。现在可能开始走强一点。

c) 相比3支股票,我觉得新电信长远的潜力比较好。新电信已经拓展海外市场,他的营业额已经不限制在新加坡。澳洲是最大的投资。他们也在印尼和印度有生意。开始可能不容易甚至亏钱,可是长期会受益。

4. 本地股市走势接下来的展望?什么原因?

海指已经从2950跑到了3038点。我们觉得现在海指可能在2950点到3150点之间波动。如果到了3150点要小心。如果跌到2950点是一个机会。是否现在会继续往上走,我们要看美国。这个星期还是有可能往上走的。

5. 纽约华尔街股市接下来的波动,是起还是跌?

我觉得这个上升的趋势是有可能继续的。之前当Bernanke 上台讲话的时候,很多时候股市都会上。现在我们觉得Yellen 似乎得到了Bernanke 的真传,每次上台都得到华尔街的欢迎,股市通常表现不错。这个星期四Yellen又会上台,我们看是否这对股市是利好消息。

6. 本地个别领域方面,哪一些行业的股票会有好的表现?

今年年头我上节目时又推荐环保领域的股票,也特别让大家注意Utd Envirotech。当时是80cts多。现在已经是$1.25了。虽然我觉得环保领域因为中国的原因还是今年受瞩目的领域,但是这支股已经跑太多了,大家要小心。

我现在在留意医药领域, 特别是Raffles Medical 大家留意一下。几个星期前节目让我研究讲一下这支股票。当时接近$3.06。现在是$3.17。我们觉得这支股票可做长期投资。因为Bugis会在开医院,长期值得投资。

7. 投资者接下来需要注意哪些因素?

今年我觉得投资者要注意联储局是否在年底会要准备提高利率。目前来看,最可怕的是利率的上升。半年前,股市一定有波动。短期,大家可以称这个时候做好功课,留意着一次盈利的报告,看哪一支股票好的再投资。

8. 你怎样看待以下个别领域的走向:产业股和建筑业股?

我觉得产业股和建筑股暂时还没什么起色。但是我们从报纸都可以看得到,政府现在面对各界的压力,房地产发展商,中介公司希望把一些降温措施解出。我估计如果房地产还是低迷的状态,确实第2季度政府可能会对松懈一些降温措施。一旦这样做,大家就买房地产股!

All major indices followed our bullish call recently

Dear Friends,

We are proud as well as fortunate to say we have correctly predicted the turnaround again! A good start to the year! Hope you followed on our call! A few weeks ago, people were screaming at a stock collapse in 2014. Emerging market is finished.

I think some of these friends are now caught by this sudden turnaround.

Let me recap some of our predictions so far this year:

1) Do you remember that we mentioned that we are looking at DOW to rebound at the 200 day MA?

Check out this article when DOW touch the 200 day MA

http://www.danielloh.com/2014/01/wish-everybody-wonderful-wonderful-2014.html

We emphasized that we think the end is near in this article when it closes 2 days below the 200 day MA

http://www.danielloh.com/2014/02/tomorrow-non-farm-payroll-is-crucial.html

That is also the day the bottom comes!

2) In an article on 28th Jan, we mentioned that Hang Seng is set for a rebound 21500-22000. When it drops to lowest 21200, we tell our radio audience to buy Hang Seng and I am looking at HK stocks now!

Today Hang Seng is at 22536.

In the same article, we urged everybody to buy Shanghai Composite at 2000. Now Shanghai Composite is 2135. It is barely 2 weeks since we last say it.

3) In another article dated 3 Jan, we mentioned to buy gold at $1200 and set our target at $1320.

http://www.danielloh.com/2014/01/a-mid-term-reversal-in-gold-is-in-cards.html

One and a half month has past and now gold is $1329, reaching our target!

4) We also mentioned to buy KLCI when it is below 1800. Now KLCI is hovering above 1800 at around 1820.

5) In another article we mentioned to buy Aussie dollars when it is below 0.8800.

http://www.danielloh.com/2014/01/is-it-time-to-invest-in-aussie-dollars.html

Now Aussie dollar futures is at 0.9000

6) And lastly talking about the STI, I mentioned in radio 958FM that STI should turn around at 3000. At most give it another 50 points, at 2950 is really CNY Ang Bao!

Article in Chinese:

http://www.danielloh.com/2014/02/radio-interview-last-friday-is-it-good.html

Now STI has reached 3069! Not much, but I am sure quite a bit of turnaround having ran 100 points in 2 short weeks!

So far this year, we fortunate in our predictions again. A good start to the year!

Hope you earned a BIG CNY ang bao along with us!

Do come for our preview seminars where we will give you our forward guidance again! Remember that there is always a method to predict turnarounds.

Look at our other posts to find the seminar dates.

We are proud as well as fortunate to say we have correctly predicted the turnaround again! A good start to the year! Hope you followed on our call! A few weeks ago, people were screaming at a stock collapse in 2014. Emerging market is finished.

I think some of these friends are now caught by this sudden turnaround.

Let me recap some of our predictions so far this year:

1) Do you remember that we mentioned that we are looking at DOW to rebound at the 200 day MA?

Check out this article when DOW touch the 200 day MA

http://www.danielloh.com/2014/01/wish-everybody-wonderful-wonderful-2014.html

We emphasized that we think the end is near in this article when it closes 2 days below the 200 day MA

http://www.danielloh.com/2014/02/tomorrow-non-farm-payroll-is-crucial.html

That is also the day the bottom comes!

2) In an article on 28th Jan, we mentioned that Hang Seng is set for a rebound 21500-22000. When it drops to lowest 21200, we tell our radio audience to buy Hang Seng and I am looking at HK stocks now!

Today Hang Seng is at 22536.

In the same article, we urged everybody to buy Shanghai Composite at 2000. Now Shanghai Composite is 2135. It is barely 2 weeks since we last say it.

3) In another article dated 3 Jan, we mentioned to buy gold at $1200 and set our target at $1320.

http://www.danielloh.com/2014/01/a-mid-term-reversal-in-gold-is-in-cards.html

One and a half month has past and now gold is $1329, reaching our target!

4) We also mentioned to buy KLCI when it is below 1800. Now KLCI is hovering above 1800 at around 1820.

5) In another article we mentioned to buy Aussie dollars when it is below 0.8800.

http://www.danielloh.com/2014/01/is-it-time-to-invest-in-aussie-dollars.html

Now Aussie dollar futures is at 0.9000

6) And lastly talking about the STI, I mentioned in radio 958FM that STI should turn around at 3000. At most give it another 50 points, at 2950 is really CNY Ang Bao!

Article in Chinese:

http://www.danielloh.com/2014/02/radio-interview-last-friday-is-it-good.html

Now STI has reached 3069! Not much, but I am sure quite a bit of turnaround having ran 100 points in 2 short weeks!

So far this year, we fortunate in our predictions again. A good start to the year!

Hope you earned a BIG CNY ang bao along with us!

Do come for our preview seminars where we will give you our forward guidance again! Remember that there is always a method to predict turnarounds.

Look at our other posts to find the seminar dates.

Monday, 17 February 2014

How our graduate makes US$226,425.75 Profits in 6 months last year?

Dear Friends,

It is always a joy to see my graduates make money consistently in the investment market!

Ever since I started teaching this secret of making money, a lot of our graduates have benefited from it.

Last week, we have a graduates gathering sharing session where a few graduates presented their portfolio and results.

One of them is Cindy, who has made US$226,425.75 in 6 months!

This is Cindy's portfolio for the whole year 2013.

This is Cindy sharing with the class how she compounded her wealth starting with US$60,000 to make US$226,425.75 profits!

Last week I showed a full house packed with people how I managed to grow my 2013 account 8 times in 1 year!

After years being in the investment business, I truly believe that only the minority makes money from the stock market.

There are ways and methods to know how to be this minority and it would probably take 3 hours to share with you my method.

If you would really like to find out how I consistently grow my portfolio 10-15% PER MONTH, and consistently make US$20-$30k PER MONTH, do come for our FREE Sharing session on

------------------------------------------------------------------

Learn about the SECRETS of the Investment Market!

You shall learn:

1) How do you double your account in 1 year systematically even when market is bad?

2) Market Outlook for the Singapore and US markets

3) What are the sectors in play this quarter?

4) Secret Strategies to increase your winning probability in trading

If you would really like to find out how I consistently grow my portfolio 10-15% PER MONTH, and consistently make US$20-$30k PER MONTH, do come for our FREE Sharing session on

------------------------------------------------------------------

Free Seminar

<< Trading for a Living in the Investment Market >>

Learn about the SECRETS of the Investment Market!

You shall learn:

1) How do you double your account in 1 year systematically even when market is bad?

2) Market Outlook for the Singapore and US markets

3) What are the sectors in play this quarter?

4) Secret Strategies to increase your winning probability in trading

In the session, you shall see Daniel Loh <2013 investment portfolio> how he grow his account 800% across the months!!!

Time: 7pm -10pm

Venue: 141 cecil street, Tung Ann Association Building

#07-02 S(069541), Singapore

Tanjong Pagar MRT exit G, walk straight 80m, opp traffic light

Speaker: Daniel Loh

Cost: Free

To register pls click here

or SMS <Name><Email><HP><Date><Number of seats> to 93676623

Date:

18 Feb (Tue) English Session

19 Feb (Wed) Chinese Session 华文讲座

Time: 7pm -10pm

#07-02 S(069541), Singapore

Tanjong Pagar MRT exit G, walk straight 80m, opp traffic light

Speaker: Daniel Loh

Regular invited speaker for Mediacorp FM958

Regular invited speaker for Mediacorp Channel 8 Financial Programmes

SIAS investment trainer

Invited speaker for Phillip Securities

SIAS investment trainer

Invited speaker for Phillip Securities

Invited speaker for Affin Investment Bank

Cost: Free

To register pls click here

or SMS <Name><Email><HP><Date><Number of seats> to 93676623

Subscribe to:

Posts (Atom)

Apple 5G phone will be a revolution! How do you take advantage of this hype?

Dear Friends, It is a well known fact that US is trying to catch up with the 5G technology of China. That is the reason why US has viewed ...